(Amendment No. )

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material 240.14a-12 | |

| ☒ | No fee required. | |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | ||||

| ||||

| ||||

| ||||

0-11. | ||||

|

| OUR MISSION | ||

Improve health,

| OUR STRATEGIC PILLARS | ||

• Expand globally |

2023 AT A GLANCE | ||||||||||||||||

| 160+ million patient interactions |  | $12.16 billion FY 2023 revenue |  | 67,000+ mission-driven employees |

84% of the new drugs and therapeutic products approved by the U.S. FDA in 2023 included Labcorp collaboration | ||||||||||

| 600+ million tests performed |

| 130+ new tests launched |

| ~100 countries served globally | |||||||||||

LETTER TO SHAREHOLDERS

Letter from our Chair and Chief Executive Officer

| “Labcorp had a transformational year in 2023. We continued to focus on and advance our near-term and long-term growth opportunities and successfully completed the spin of our former clinical development and commercialization services business, Fortrea Holdings Inc., now an independent publicly held company. At the same time, we delivered strong results across the enterprise and have strong momentum heading into 2024.” ADAM H. SCHECHTER |

Dear Shareholder:Shareholder,

On behalf of management and the board of directors, I hopeinvite you willto join us for the 20182024 Annual Shareholder Meeting of Shareholders of Laboratory Corporation of America Holdings, which will beLabcorp, held on Thursday,Tuesday, May 10, 201814, 2024, at 9:00 a.m. Eastern Time. The Annual Meetingmeeting will be a virtual meeting of shareholders to be held over the Internet, duringwebcast live at www.virtualshareholdermeeting.com/LH2024 at which time you will be able tocan vote your shares electronically and submit your questions duringquestions.

Labcorp had a transformational year in 2023. We continued to focus on and advance our near-term and long-term growth opportunities and successfully completed the live webcastspin of our former clinical development and commercialization services business, Fortrea Holdings Inc. (“Fortrea”), now an independent publicly held company. At the same time, we delivered strong results across the enterprise and have strong momentum heading into 2024. Our core business segments, Diagnostics Laboratories and Biopharma Laboratory Services, which includes Central Laboratory Services and Early Development Research Laboratories, are well-positioned to better meet customer needs and capture market opportunities this year and into the future.

Fortrea Spin

Completing the spin of Fortrea allowed Labcorp greater strategic flexibility and created significant value for our shareholders. The completion of the meeting.spin is a testament to our teams’ steadfast work ethic, focus on our customers and ability to execute.

Our Business Strength

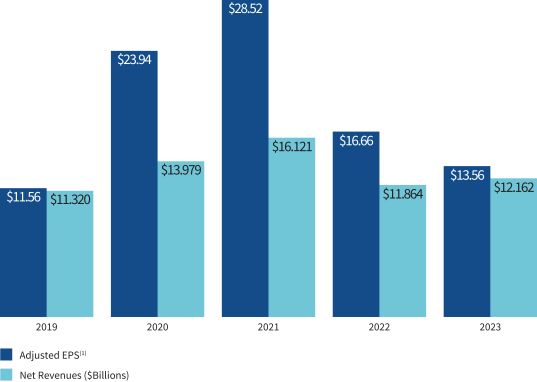

In 2023, we generated $12.16 billion in revenue, $1.20 billion in operating cash flow, $748.7 million in free cash flow from continuing operations (operating cash flow less capital expenditures and excluding spin-related items), diluted earnings per share of $4.33, and adjusted earnings per share of $13.56. Moreover, our Base Business, the business operations excluding COVID-19 PCR and antibody testing, is well-positioned for continued success in 2024.

Our Diagnostics business benefited from increased demand for routine and esoteric testing and continued progress in establishing collaborations with health systems and hospitals. Biopharma Laboratory Services is also well-positioned for success in 2024 due to our customer relationships, extensive scientific expertise, and global scale.

Near-term and long-term significant growth opportunities

We continue to make notable progress on our near-term and long-term areas of focus that we believe will drive continued growth.

In the near-term, we are now well-established as the partner of choice for hospitals and health systems and regional/local laboratories. Labcorp brings the scientific expertise, innovation, and robust data and analytics capabilities needed to serve patients efficiently and with high quality, enabling hospitals to be at the forefront of science, technology and innovation in testing. The pipeline of opportunities within health systems and regional/local labs represents a tremendous opportunity for the Company.

We are also bringing new testing, particularly specialty testing including companion diagnostics, to patients and physicians. Our focus is on four key areas of specialty testing: oncology, women’s health, autoimmunology and neurology. We anticipate that these clinical areas will outpace the growth of other specialties. The development of specialty tests and companion diagnostics will continue to make us an attractive partner to health systems and to our biopharmaceutical partners as they develop more therapies for specialty areas.

Cell and gene therapies make up approximately 20% of pharmaceutical companies’ pipelines, with more than 2,000 trials underway, and we expect this market to grow at a substantially higher rate than other therapies over the next five years. In the longer term, we see great opportunities for the Company to

2024 PROXY STATEMENT

LETTER TO SHAREHOLDERS

support the development and commercialization of these therapies and to make them more available to patients.

In addition, we continue to expand our consumer-centric capabilitiesand look for opportunities to expand into this market with more convenient and innovative offerings.

Finally, we are leveraging our global laboratory network to expand our business globally by bringing specialty testing capabilities outside of the U.S. Our scale, portfolio breadth and geographic presence are differentiators and uniquely position us to expand into new markets.

Prioritizing Governance

Labcorp’s long-standing commitment to strong corporate governance is an important part of our efforts to create long-term value for shareholders. Our board prioritizes empowering inclusive leadership, building and sustaining a diverse talent pipeline, and creating an environment for engagement across the enterprise and in our communities.

We also prioritize two-way communication with our shareholders and value the input we receive. We share the insights gained from these meetings with the full board on a regular basis so that all directors benefit from our shareholders’ perspectives.

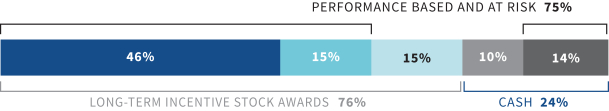

Our compensation program is designed to create strong alignment between our executives’ pay and the Company’s performance. The Labcorp board believes our current compensation program, which is focused on performance-based and variable compensation, achieves this objective, and we will continue to refine the program to reflect our strategic execution and the best interests of shareholders. I encourage you to review the discussion of our compensation program that begins on page 47.

Your Vote is Important

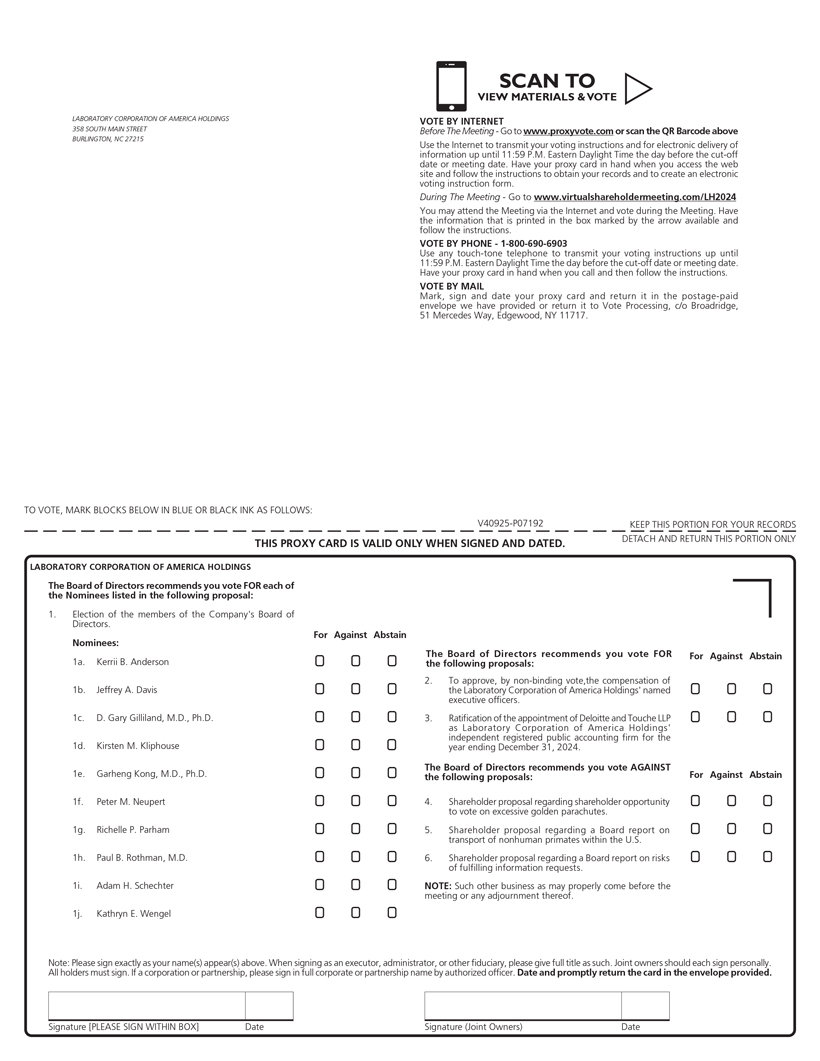

At the 2024 Annual Meeting, we will ask you to: 1)to (1) elect ten director nominees named in the attached proxy statement to our Board of Directors; 2)nominees; (2) approve, on anon-binding advisory basis, the compensation of our named executive compensation; and 3)officers; (3) ratify the appointment of PricewaterhouseCoopersDeloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2018. We will also discuss2024; (4) vote upon three shareholder proposals; and (5) act on any other business matters properly brought before the meeting.

In reviewingPlease review the Proxy Statement you will find detailed information beginning on page 1924 about the skills and qualifications of our director nominees and why wedirectors. We believe they are the right people to represent you.oversee our Company.

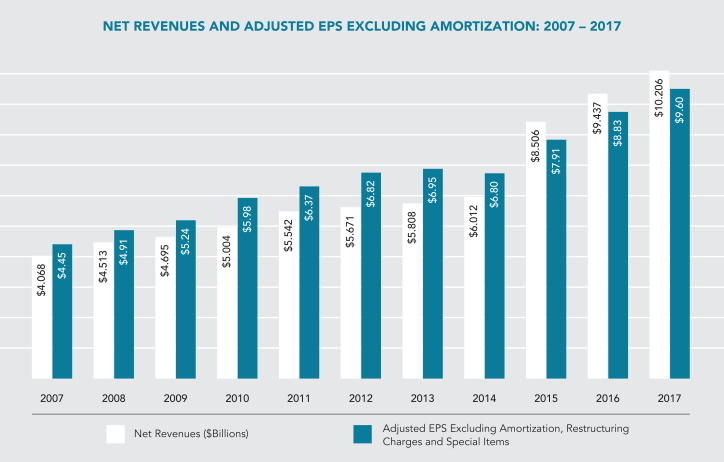

As discussed in our Compensation Discussion and Analysis, which begins on page 27, we continue to maintain an executive compensation program that creates strong alignment between our executives’ pay and the performance of the Company. Over the past several years, our compensation program has evolved to better align with our changing business and industry, as well as to reflect feedback we have received from our shareholders. The Board believes our current compensation program, which is highly performance-based, incentivizes our management team to execute on our strategic goals and is strongly aligned with the interests of our shareholders.

As part of our ongoing shareholder engagement efforts, since our 2017 Annual Meeting of Shareholders, senior management engaged with shareholders representing more than 75 percent of the Company’s outstanding shares. Discussions with our shareholders were primarily focused on a review of our performance and differentiated capabilities, our transformational strategy to become a leading life sciences company, our corporate governance practices and our executive compensation program. In response to discussions with our shareholders, in January 2017 our Board of Directors adopted proxy access, which permits eligible shareholders to submit director nominees to be included in the Company’s proxy statement, commencing with this Annual Meeting.

Your vote is very important to us. Whether or not you plan to participate in the 2018 Annual Meeting, itIt is important that your shares are represented and voted on at the meeting. I urge you to promptly vote and submit your proxy via the Internet, by phone, or if you receive paper copiesby mail.

Looking Ahead

We will continue to deliver the best possible laboratory solutions for our customers as we move forward with an urgency and focus on our enterprise strategy and continue to advance our mission to improve health and to improve lives.

I also want to thank our more than 67,000 employees around the world, who are the driving force behind what we do every day. We are excited about the opportunities ahead of us, and we believe the proxy materials by mail, by following the instructions on the proxy card or voting instruction card.future is bright for Labcorp and its patients, customers, and shareholders.

On behalf of management and the Board of Directors, I would like to express our appreciationboard, thank you for your continued ownership of LabCorp.support. We look forward to your participation during the 20182024 Annual Meeting.

Sincerely,

David P. KingAdam H. Schechter

Chairman of the Board,

President and Chief Executive Officer

April 4, 2024

LABORATORY CORPORATION OF AMERICA HOLDINGS

Notice

Letter from our Lead Independent Director

| “For 2023, the achievements that stand out most to me, against the backdrop of continued global economic challenges and the successful spin of Fortrea, are the Company’s notable advancements in each of our focus areas.... Labcorp also remains committed to strong corporate governance practices. Maintaining a qualified, diverse and majority independent board, with periodic refreshment to bring in new and different perspectives, is the cornerstone of our approach to sound corporate governance.” GARHENG KONG, M.D., Ph.D. |

Dear Shareholder,

In 2023, a transformational year, Labcorp delivered strong results, that were attributable to the strategic focus and leadership provided by the board of 2018 Annual Meetingdirectors and management and the dedication and contributions of our more than 67,000 dedicated employees across the globe.

Highlights of Shareholders

Thursday, May 10, 2018

9:00 a.m., Eastern Daylight Time

The 2018 Annual Meeting will be a virtual meetingthe Company’s 2023 performance are available throughout this Proxy Statement. For 2023, the achievements that stand out most to me, against the backdrop of shareholders to be held as a live webcast overcontinued global economic challenges and the Internet at LH.onlineshareholdermeeting.com.

ITEMS OF BUSINESS:successful spin of Fortrea, are the Company’s notable advancements in each of our focus areas:

| expanding its deep relationships with health systems and other laboratories; |

| • | continuing to deliver advancements in diagnosis and treatment in key clinical areas such as oncology, women’s health, autoimmunology and neurology; |

| • | leading in the development of cell and gene therapies, a vital and exciting frontier in the treatment of genetic diseases; |

| • | expanding its consumer-facing capabilities; and |

| • | using its global laboratory network to provide biopharmaceutical clients with access to the Company’s comprehensive offering of specialty testing. |

Corporate Governance

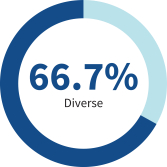

Labcorp also remains committed to strong corporate governance practices. Maintaining a qualified, diverse and majority independent board, with periodic refreshment to bring in new and different perspectives, is the cornerstone of our approach to sound corporate governance. In addition to my becoming lead

independent director, we welcomed Kirsten Kliphouse and Paul Rothman, M.D. to the board in October 2022 and June 2023, respectively. We also appointed new chairs for our Audit, Compensation and Human Capital, and Nominating and Corporate Governance Committees.

Lead Independent Director Responsibilities

The board believes that having a robust lead independent director role with clearly defined roles and responsibilities that support independent oversight of management provides for an efficient and effective leadership structure for the Company.

I was elected to the position of lead independent director by the independent directors of our board. In this role, I serve as a liaison between the board Chair and the independent directors, preside over executive sessions of the board, provide feedback from executive sessions to the Chair, and advise the Chair with respect to the schedule, agenda, and information for Board meetings in order to facilitate timely and appropriate information flow to and from the board. This structure serves to increase board effectiveness, strengthen our ongoing dialogue between management and the independent directors, and ensures that the board’s recommendations and certain other deliberations are delivered to the Chair and management team.

Shareholder Engagement

Additionally, the board works closely with the Company’s management team to prioritize two-way communication with our shareholders. Discussions with shareholders centered on our governance practices, business strategy, approach to inclusion, diversity, and belonging, our efforts to support sustainability, and how we give back to the communities we serve.

2024 PROXY STATEMENT

LETTER TO SHAREHOLDERS

I remain confident that the Company’s track record of innovation and our extraordinary workforce will continue to have a meaningful impact on improving health and improving lives in a responsible, sustainable way. On behalf of the Labcorp Board of Directors, we thank you for your continued support and hope you can join us at Labcorp’s 2024 Annual Shareholder Meeting.

Sincerely,

Garheng Kong, M.D., Ph.D.

Lead Independent Director

April 4, 2024

LABORATORY CORPORATION OF AMERICA HOLDINGS

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

Notice of 2024 Annual Meeting of Shareholders

DATE & TIME Tuesday, May 14, 2024 9:00 a.m., Eastern Daylight Time

RECORD DATE March 20, 2024 Only shareholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the 2024 Annual Meeting. |

WHERE The 2024 Annual Meeting of Laboratory Corporation of America Holdings will be a virtual meeting of shareholders to be held as a live webcast over the Internet at: www.virtualshareholdermeeting.com/LH2024 |

ITEMS OF BUSINESS

| 1 | To elect ten directors from among the nominees named in the attached Proxy Statement. |

To approve, on anon-binding advisory basis, the compensation of our named executive |

To ratify the appointment of |

To vote upon three shareholder proposals described in the attached Proxy Statement, if properly presented. | ||

| 5 | To consider any other business properly brought before the 2024 Annual Meeting. |

RECORD DATE:

March 23, 2018. Only shareholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the 2018 Annual Meeting.

PROXY VOTING:VOTING

Your vote is important. We encourage you to mark, date, sign, and return the enclosed proxy/voting instruction card or, if you prefer, to vote by telephone or by using the Internet.

March 30, 2018

April 4, 2024

By Order of the Board of Directors

F. Samuel Eberts IIISandra D. van der Vaart

Secretary

Important notice regarding the availability of proxy materials for the 2024 Annual Meeting of Shareholders to be held on May 10, 2018.14, 2024. Our Proxy Statement and Annual Report to Shareholders are available atat: www.proxyvote.com.

2024 PROXY STATEMENT

Table of Contents

| 1 | |||||||

| 1 | |||||||

| |||||||

| 6 | |||||||

| 9 | |||||||

| GENERAL INFORMATION | 10 | ||||||

| 10 | |||||||

| 10 | |||||||

| 11 | |||||||

| 11 | |||||||

| 13 | |||||||

| 13 | |||||||

| CORPORATE GOVERNANCE | 14 | ||||||

| 16 | |||||||

| 18 | |||||||

| 21 | |||||||

| 23 | |||||||

| 25 | |||||||

| 26 | |||||||

| 27 | |||||||

| |||||||

| |||||||

| 29 | |||||||

| 29 | |||||||

| 30 | |||||||

| DIRECTOR COMPENSATION | 31 | ||||||

| 31 | |||||||

| 32 | |||||||

| 32 | |||||||

| PROPOSAL | 33 | ||||||

| 34 | |||||||

| EXECUTIVE OFFICERS | 44 | ||||||

| COMPENSATION DISCUSSION & ANALYSIS | 47 | ||||||

| 66 | |||||||

| 104 | |||||||

| 104 | |||||||

| USE OF NON-GAAP FINANCIAL MEASURES | 105 | ||||||

2024 PROXY STATEMENT

Cautionary Note Regarding Forward-Looking Statements

As used in this Proxy Statement, “Labcorp,” the “Company” and “we” may refer to Laboratory Corporation of America Holdings itself, one or more of its subsidiaries, or Laboratory Corporation of America Holdings and its consolidated subsidiaries, as applicable.

This Proxy Statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on current expectations, forecasts, assumptions, and other information available to Laboratory Corporation of America Holdings as of the date hereof. Forward-looking statements involve inherent risks and uncertainties, include statements regarding Labcorp’s expectations, beliefs, intentions, or strategies regarding the future, including with respect to business, financial, operational, compensation, and environmental, social, and governance matters, and can be identified by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “should,” “seeks,” “approximately,” “estimate,” “goal,” “intend,” “may,” “plan,” “should,” “will,” and “would,” or the negative of those words or other similar terminology. Labcorp’s actual results, performance, or events may differ materially from these forward-looking statements made or implied due to a number of risks and uncertainties relating to Labcorp’s business, including the effect of global economic and market conditions, Labcorp’s ability to execute its business and growth strategies, including statements relating to the completed spin-off of Fortrea Holdings Inc., Labcorp’s ability to achieve its environmental, social, and governance goals, future business strategies, expected savings, benefits, and synergies from certain initiatives and from acquisitions and other strategic transactions and partnerships, opportunities for future growth, and the risks and uncertainties discussed in Labcorp’s Annual Report on Form 10-K for fiscal year ended December 31, 2023 filed with the Security and Exchange Commission (the “SEC”) on February 26, 2024 (“2023 Annual Report”), as well as Labcorp’s other filings with the SEC. Such forward-looking statements speak only as of the time they are made and Labcorp undertakes no obligation to publicly revise or update any forward-looking statements made in this Proxy Statement, whether as a result of new information, future events or circumstances, or otherwise, except as required by law.

Information contained on or available through our website is not incorporated by reference in or made part of this Proxy Statement and any references to our website are intended to be inactive textual references only.

LABORATORY CORPORATION OF AMERICA HOLDINGS

PROXY SUMMARY

Proxy

Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

Annual Meeting of Shareholders

DATE & TIME Tuesday, May 14, 2024, RECORD DATE March 20, 2024 | ||

MAILING DATE This | ||

VIRTUAL MEETING www.virtualshareholder meeting.com/LH2024 |

VOTING Shareholders as of the | |

Voting Matters and Vote Recommendation (page 5)

| Voting Matters and Vote Recommendation (PAGE 11) The following table summarizes the proposals to be considered at the 2024 Annual Meeting and the Board’s voting recommendation with respect to each proposal.

2024 PROXY STATEMENT 1 PROXY SUMMARY How to Cast Your Vote (PAGE 12) You can cast your votes by any of the following methods:

Environmental, Social, and Governance (“ESG”) Highlights (PAGE 15)

2 LABORATORY CORPORATION OF AMERICA HOLDINGS

PROXY SUMMARY We have a diverse workforce with a broad range of unique experiences and In 2023, we continued our efforts to improve our inclusion and diversity efforts for the benefit of the Company and our We seek to take actions that will preserve the environment and evolve our operations in increasingly sustainable ways and We received operations and activities linked to our sustainability drivers and made notable progress toward our near-term environmental and sustainability targets. For example, since 2022, we have decreased our Scope 2 (market-based) emissions per million dollars of revenue by 8%, increased our total renewable electricity and credits by 7%, and reduced our total energy consumption per million dollars of revenue by 5%. Moreover, versus our 2021 baseline, we have improved the our U.S. vehicle fleet by 5.4%, and versus our 2020 baseline, we have increased waste reclaimed by 22%. (To more accurately reflect our operations following the

We also continue to We publish a Corporate Responsibility Report, which highlights our commitment to environmental and social responsibility, Shareholder Engagement (page 16) Through our robust and regular shareholder engagement process, we have received valuable feedback that informs our decisions

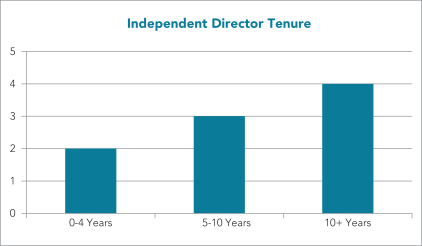

2024 PROXY STATEMENT 3 PROXY SUMMARY Snapshot of 2024 Director Nominees Our Director Nominees Exhibit an Effective Mix of Skills, Experiences, Diversity, and Fresh Perspectives

SKILLS AND EXPERTISE

Business Strategy Experience

Corporate Finance and M&A

Corporate Governance Experience

Executive Leadership Experience

Healthcare/Clinical Research Background

International Experience

Risk Management Experience

Sales and Marketing Background

Talent Management Expertise

Technology/Cybersecurity Expertise

4 LABORATORY CORPORATION OF AMERICA HOLDINGS

PROXY SUMMARY We continue to demonstrate a strong commitment to corporate governance that reinforces our

The following table provides summary information about each director nominee.

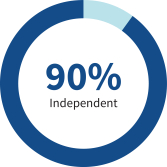

2024 PROXY STATEMENT 5 PROXY SUMMARY Governance Highlights We have a long-standing commitment to strong corporate governance practices. These practices

Key Financial Highlights The Company achieved solid operational and financial performance across a broad range of measures.

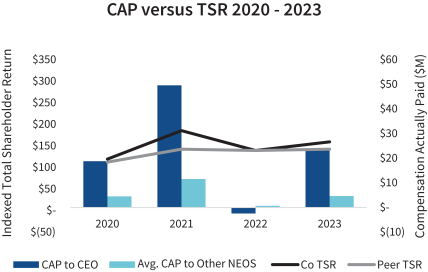

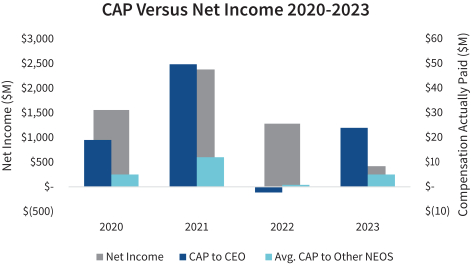

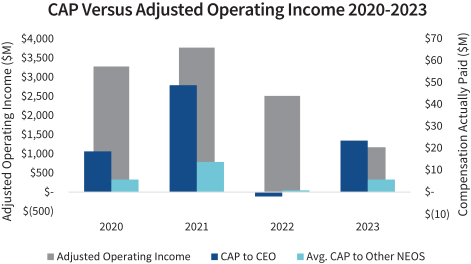

Executive Compensation Pay for Performance (page

6 LABORATORY CORPORATION OF AMERICA HOLDINGS

PROXY SUMMARY 2023 Executive Total Compensation The

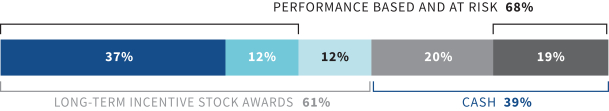

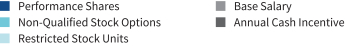

For CEO PAY MIX BASED ON TARGET AWARD OPPORTUNITIES

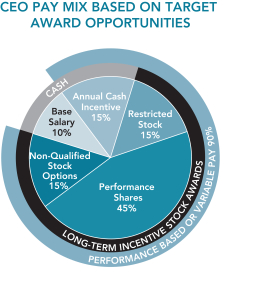

OTHER NEO PAY MIX BASED ON TARGET AWARD OPPORTUNITY1

2024 PROXY STATEMENT 7 PROXY SUMMARY Advisory Vote to Approve Executive Compensation (page We ask that our shareholders approve the advisory resolution on the compensation of our named executive Our market-leading compensation practices are designed with features to further align the interests of our executives with those of our shareholders:

When evaluating prospective candidates for director, including those nominated by shareholders, the Nominating and Corporate Governance Committee conducts individual evaluations of the candidates, taking into account the criteria enumerated in the Company’s Corporate Governance Guidelines (see description below). Among other things, the Committee considers whether prospective candidates have:

The Company’s Corporate Governance Guidelines provide that the Nominating and Corporate Governance Committee is responsible for reviewing with the Board the appropriate skills and characteristics required of Board members in the context of the Company’s business needs and the current composition of the Board. This assessment includes, among other characteristics, diversity, age, background, skills, and expertise in the context of the perceived needs of the Board at the time of such assessment. The Company believes that Board membership should reflect diversity in its broadest sense, including persons diverse in gender, race, ethnicity, and geography, 24 LABORATORY CORPORATION OF AMERICA HOLDINGS CORPORATE GOVERNANCE Director candidates, other than sitting directors, may be interviewed by the As a part of the Company’s continued process of Board renewal and succession planning, the Nominating and Corporate Governance Committee sought to add an additional director to the Board, particularly one who had a background and experience that included medical global health system oversight expertise. As part of its efforts to identify potential nominees, the Board engaged Spencer Stuart, a professional search firm, to assist with the search. After a comprehensive review, Spencer Stuart identified Dr. Rothman as a potential Board member whose profile closely matched the qualifications that the Nominating and Governance Committee had identified. Following additional consideration by the Board and based on the recommendation of the Nominating and Corporate Governance Committee, Dr. Rothman was appointed to the Board on June 6, 2023. Communications with the Board Shareholders and interested parties may communicate with the Board, individually or as a group, by submitting written communications to the appropriately addressed Board member(s), c/o Corporate Secretary, Laboratory Corporation of America Holdings, 358 South Main Street, Burlington, North Carolina 27215. All communications with the Board will be reviewed initially by the Corporate Secretary, who will relay all communications to the appropriate director or directors unless the communication is:

Directors may decide whether any of the communications addressed to their attention should be presented to the full Board, to one or more of its The Nominating and Corporate Governance Committee, comprised entirely of independent,non-employee directors, has reviewed and approved the foregoing procedures and is responsible for recommending changes to the procedures as necessary.

2024 PROXY STATEMENT 25 CORPORATE GOVERNANCE

Board Committees and Their Functions The Board has four standing

Charters for each of the

CORPORATE GOVERNANCE

• overseeing the Company’s management of financial risks, including with respect to risk assessment and risk management;

• reviewing all related party transactions in accordance with the Company’s Related Party Transactions Policy; • producing an Audit Committee report as required by the SEC to be included in the Company’s annual proxy statement; and • regularly overseeing and reviewing the Company’s cybersecurity and other information technology risks, controls and procedures, including the potential impacts of such risks on the Company’s business, financial results, operations and reputation, and the Company’s plans to mitigate cybersecurity risks and to respond to data breaches, and regularly receiving reports from, and meeting with, the Chief Information Risk Officer and Chief Information and Technology Officer to review cybersecurity issues. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Audit Committee meets regularly and in executive sessions with PricewaterhouseCoopers,the Company’s independent auditor, management, and the Company’s internal auditors. In its meetings with PricewaterhouseCoopersthe independent auditor and the internal auditors, the Audit Committee discusses, among other things, the overall scope and plans for their respective audits, the results of their examinations, critical audit matters, and their evaluations of the Company’s internal controls.

The Audit Committee constitutes a separately-designatedseparately designated standing audit committee established in accordance with sectionSection 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has determined that Ms. Anderson, Mr. Davis, and Mr. Neupert are each an “audit committee financial expert” as defined in the SEC’s rules. The Board has also determined that both Ms. Anderson, Mr. Davis, and Mr. Neupert each have the “accounting or related financial management expertise” required by the Listing Standards.

Compensation Committee

Members: Mr. Schechter (Committee Chair), Mr. Bélingard, Dr. Kong, and Mr. Mittelstaedt.2024 PROXY STATEMENT 27

The Compensation Committee is responsible for assisting the Board with the following functions:

CORPORATE GOVERNANCE

The Compensation Committee has delegated to Mr. King the responsibility of determining the individual and strategic goals for the annual incentive plans for each of the other NEOs, subject to the approval of the Compensation Committee. For a discussion of Mr. King’s role in determining executive compensation, see the “Compensation Discussion and Analysis” section below (page 27).

The Compensation Committee has the sole authority to retain and terminate independent compensation consultants to assist the Committee in its evaluation of executive officer and director compensation. For 2017, the Compensation Committee retained FW Cook as its outside independent compensation consultant. FW Cook does no other work for the Company or its management except as directed by the Chairman of the Compensation Committee. See the “Compensation Discussion and Analysis” section below (page 27) for more information about FW Cook’s role in recommending the amount or form of executive compensation.

Nominating and Corporate Governance Committee

Members: Mr. Neupert (Committee Chair), Ms. Anderson, Dr. Kong, and Mr. Mittelstaedt

The Nominating and Corporate Governance Committee is responsible for assisting the Board with the following functions:

Compensation and Human Capital Committee | MEMBERS Ms. Parham (Committee Chair), Mr. Bélingard, Dr. Kong, and Ms. Wengel | |

The CHC Committee is responsible for assisting the Board with the following functions: | ||

• • reviewing, approving, and making recommendations to the independent directors of the Board regarding the CEO’s compensation, taking into account the corporate goals and objectives relevant to CEO compensation and evaluating the CEO’s performance in light of those goals and objectives, and reviewing and approving the compensation arrangements for other executive officers; • reviewing and evaluating the compensation paid to the Company’s non-employee directors; • reviewing the CEO’s annual report on management development and assisting the Board in overseeing management succession plans; • monitoring the evolving executive compensation landscape and considering shareholder feedback; | • reviewing and overseeing the Company’s incentive compensation and equity plans; • evaluating the Company’s pay practices in relation to the Company’s risk profile and compensation philosophy; • approving and periodically assessing the effectiveness of any policies or plans related to the recoupment of incentive compensation, or “clawback” policies; • overseeing the Company’s policies and strategies related to its culture and human capital management, including inclusion, diversity, and belonging; • producing a CHC Committee report as required by the SEC to be included in the Company’s annual proxy statement; and • assisting the Board in overseeing development and corporate succession plans for the corporate senior leadership team. | |

Nominating and Corporate Governance Committee | MEMBERS Dr. Kong (Committee Chair), Ms. Anderson, Mr. Neupert, and Ms. Parham | |

The Nominating and Corporate Governance Committee is responsible for assisting the Board with the following functions: | ||

• identifying individuals qualified to become Board members, consistent with criteria approved by the Board and succession planning; • evaluating and analyzing annually the independence and commitments of each member of the Board; • recommending to the Board the director nominees for the annual meeting of shareholders and the director nominees for each Board Committee; • reviewing the Board’s committee assignments and considering the rotation of Chairpersons and members; | • reviewing and discussing with the Board the Company’s engagement with, and responsiveness to, shareholder votes on governance matters; • reviewing and evaluating any actual or potential conflicts of interest relating to any director that may affect a director’s continued service on the Board; • reviewing and reassessing, on an annual basis, the adequacy of the corporate governance principles of the Company and recommending any proposed changes to the Board for approval; and • leading the Board in its annual self-assessment. | |

28 LABORATORY CORPORATION OF AMERICA HOLDINGS

CORPORATE GOVERNANCE

��

Quality and Compliance Committee

Members: Dr. Williams (Committee Chair), Mr. Bélingard, Dr. Gilliland, and Mr. Schechter

The Quality and Compliance Committee is responsible for assisting the Board in carrying out its oversight responsibility with respect to quality and compliance issues. This oversight responsibility includes ensuring that management adopts and implements policies and procedures that require the Company’s employees to act in accordance with high ethical standards, deliver high quality services and comply with healthcare and other legal requirements. The Quality and Compliance Committee is responsible for reviewing the Company’s processes intended to assure excellent performance and meet scientific, medical and regulatory quality performance benchmarks.

In furtherance of the foregoing, the Quality and Compliance Committee annually reviews the Company’s programs and practices related to scientific, medical and regulatory quality and compliance including a periodic reassessment of the adequacy of:

Quality and Compliance Committee

| MEMBERS Dr. Williams (Committee Chair), | |

The Quality and Compliance Committee is responsible for assisting the Board in carrying out its oversight responsibility with respect to quality and compliance issues. This oversight responsibility includes ensuring that management adopts and implements policies and procedures that require the Company’s employees to act in accordance with high ethical standards, deliver high quality services and comply with healthcare and other legal requirements. The Quality and Compliance Committee is responsible for reviewing the Company’s processes intended to assure excellent performance and meet scientific, medical, and regulatory quality performance benchmarks. | ||

In furtherance of the foregoing, the Quality and Compliance Committee annually reviews the Company’s programs and practices related to scientific, medical, and regulatory quality and compliance, including a periodic reassessment of the adequacy of: | ||

• quality and compliance policy development;

• quality and compliance reporting/tracking systems; • investigation and remediation practices for quality and compliance issues; quality and compliance reporting/tracking systems; • meeting scientific, medical, and regulatory quality performance benchmarks; • education and training of Company personnel on quality and compliance; | • quality and compliance function responsibilities, staffing and budget; and • the Company’s programs for management of ESG activities and objectives and disclosures relating to environmental, sustainability, employee health and safety, and compliance and quality matters. | |

Additionally, the Quality and Compliance Committee meets regularly, but no less than annually, with each of the Company’s Chief Compliance Officer and Chief Medical Officer and, as necessary, heads of the Company’s corporate compliance and quality functions, regarding the implementation and effectiveness of the Company’s scientific, medical, and regulatory compliance program, and receives and reviews periodic reports regarding, among other things: | ||

• compliance-related activities and on-going compliance training programs; • the quality assurance activities conducted by the quality functions; • compliance audit plans and results; • the results of internal quality audits; | • the status and results of audits, inspections, investigations, and enforcement actions by regulatory authorities; • any significant deviations observed by the Company’s quality functions; and • the status of any corrective and preventative action plans initiated by those functions. | |

Board and Committee Meetings

During 2017,2023, the Board held nine meetings and acted eleven times by unanimous written consent. In his capacity as the Lead Independent Director, Mr. Mittelstaedt chaired five meetings of the independent andnon-employee directors on the same days as the regularly scheduled Board meetings. The Audit Committee held eight meetings, the Compensation Committee held four meetings, the Nominating and Corporate Governance Committee held three meetings and the Quality and Compliance CommitteeBoard’s standing committees held foura total of 24 meetings. During 2017, eachEach of the directors attended no less than 88 percent90% of the total meetings of the Board and the Committees of which he orsuch director was a member, except for Ms. Wengel, who attended less than 75% of the total meetings of the Board and the Committees of which she was a member. Ms. Wengel attended, however, 80% of the regularly scheduled meetings of the Board and 75% of all meetings of the Board in 2023. Ms. Wengel’s overall attendance was lower in 2023 because she could not attend two special meetings that were scheduled on short notice for the same date to discuss items related to the then-imminent closing of the spin-off of Fortrea for which she had a preexisting, unavoidable conflict. In advance of these meetings, Ms. Wengel provided input on the agendas and materials to the meeting Chair. Had she been able to attend those special meetings, she would have attended more than 75% of the total meetings of the Board and the Committees of which she was a member, which is consistent with her 93% meeting attendance in 2022 and her 100% attendance in 2024 through the date of this Proxy Statement. Our Nominating and Corporate Governance Committee has determined that Ms. Wengel continues to make valuable contributions to the Board and has the commitment and capacity to fulfill her Board obligations, including as demonstrated by her ongoing level of engagement.

In his capacity as the Lead Independent Director, Mr. Neupert chaired three meetings and Dr. Kong chaired three meetings of the independent and non-employee directors on the same days as regularly scheduled Board meetings. Members of the Board are encouraged to attend the Annual Meetingour annual meetings and all of the directors who were then serving attended the 20172023 Annual Meeting of Shareholders.

2024 PROXY STATEMENT 29

CORPORATE GOVERNANCE

Corporate Governance Policies and Procedures

Corporate Governance Guidelines

The Board has adopted a set of Corporate Governance Guidelines that address a number of topics, including composition of the Board, director independence, director commitments, including limits on their ability to serve on other boards, annual self-assessment by the Board and its Committees, retirement of directors, and succession planning. The Nominating and Corporate Governance Committee reviews the Corporate Governance Guidelines on a regular basis and any proposed additions or amendments are submitted to the full Board for its consideration. Shareholders may request a printed copy of the Corporate Governance Guidelines from the Corporate Secretary or access a copy on the Investor Relations page under the Corporate Governance tab of LabCorp’sthe Investors page of Labcorp’s website at www.labcorp.com.www.Labcorp.com.

CORPORATE GOVERNANCE

Code of Conduct and Ethics

The Board has also adopted a Code of Conduct and Ethics (the “Code”) that is applicable to all directors, officers, and employees of the Company and its subsidiaries and affiliates. The Code sets forth Company policies and expectations on a number of topics, including but not limited to, conflicts of interest, confidentiality, compliance with laws (including insider trading laws), preservation and use of Company assets, and business ethics. The Code also sets forth procedures for reporting and handling any potential violation of the Code, conflicts of interest, and the appearance of any conflict of interest. The Code is regularly reviewed by management, the Audit Committee, and the Quality and Compliance Committee, and proposed additions or amendments are considered by the full Board. Shareholders may request a printed copy of the Code of Conduct and Ethics from the Corporate Secretary or access a copy under the Corporate Governance tab of the Investor RelationsInvestors page on LabCorp’sLabcorp’s website at www.labcorp.com.www.Labcorp.com. In addition, any waivers for directors, officers, and employees of the Company or amendments to the Code will also be posted on LabCorp’sLabcorp’s website.

Related Party Transactions

InThe Board has adopted a Related Party Transaction Policy pursuant to which, and in accordance with its charter, the Board’s Audit Committee, or the full Board, is responsible for reviewing and approving the terms and conditions of all related party transactions. The Company’s directors and key employees, including all members of senior management, complete annual reports disclosing, or certifying the absence of, any related party transactions. The Audit Committee reviews all potential material transactions involving related persons (as such transactions are defined by Item 404(a) of RegulationS-K as promulgated by the SEC) before allowing the Company to enter into any such transaction. The Company has not adopted a static set of criteria to be applied in evaluating a related party transaction and instead tailors the scope of its review to the particular circumstances presented by each transaction to ensure that any such transaction is thoroughly reviewed and evaluated. Based on the Company’s review of its transactions, there have been no transactions or proposed transactions considered to be material related party transactions since January 1, 2017.2023.

30 LABORATORY CORPORATION OF AMERICA HOLDINGS

Director Compensation

The Company’snon-employee director compensation is designed to attract and retain highly qualified, independent directors to represent shareholders on the Board and act in their best interest. The CompensationCHC Committee, which consists solely of independent directors, has primary responsibility for setting our non-employeedirector compensation. FW Cook, the Committee’s independent compensation consultant, assists the CompensationCHC Committee in evaluating our non-employeedirector compensation program.

Elements ofNon-Employee Director Compensation

DirectorLabcorp’s non-employee director compensation is designed to align director compensation with emerging best practices and reflect the Board’s belief thatnon-employee director compensation should not depend upon the number of meetings held, but rather on the ongoing work and role of the directors throughout the year. For 2017,The 2023 elements of our non-employee director compensation included the following:

| • | Annual |

| • | Committee Chair Annual Retainer.The Chair of each standing committee of the Board received an additional retainer, paid on a quarterly basis. The retainer for the Chair of the Audit Committee is $25,000 and the retainer for the |

| • | Lead Independent Director Annual Retainer.The additional retainer for the Lead Independent Director is $45,000, paid on a quarterly basis. |

| • | Equity Compensation.Eachnon-employee director who was then serving on the Board received a grant of restricted stock units having a value of approximately |

Company’s Common Stock on the grant date ($ |

Effective as of October 3, 2017, the annual grant of restricted stock units to eachnon-employee director was increased in value to approximately $175,000, subject to the requirements of the Company’s Director Stock Ownership Program. Because the annual equity awards for 2017 already had been granted when this change was approved, it is first effective for grants made in 2018.

In addition, theThe Company has a policy of granting to each new director that joins the Board an equity awardsaward with a prorated amount of the value of the annual award granted to all directors, with aone-year vesting period. Dr. Rothman received a grant of restricted stock units on June 6, 2023, in connection with his appointment to the Board, having a value of approximately $140,000, subject to the requirements of the Company’s Director Stock Ownership Program. The number of restricted stock units granted was determined by using the closing price of the Company’s Common Stock on the grant date ($195.38) as adjusted to account for the impact of the spin-off of Fortrea. The restricted stock units will vest fully on June 6, 2024.

| • | Reimbursement of Expenses.Each director is reimbursed for |

The decision in 2017 to increase the directors’ equity compensation award was recommended by FW Cook based on their study of

Our non-employee director compensation and wasprogram is intended to maintain director pay levels with the competitive median of the peer group used for the purposes of director compensation comparisons and broader industry benchmarks. In 2023, FW Cook conducted a study of our non-employee director compensation and confirmed that the directors’ cash and equity compensation remained consistent with market practice and as such, recommended no change to the current program.

2024 PROXY STATEMENT 31

DIRECTOR COMPENSATION

Director Stock Ownership Program

Maintaining a significant personal level of stock ownership ensures that each director is financially aligned with the interests of our shareholders. The Board believes that by holding an equity position in the Company, directors demonstrate their commitment to and belief inalignment with the long-term successstrategy and initiatives of the Company. The Company’s Director Stock Ownership Program requires eachEach non-employee director is required to acquire and maintain a number of shares having a value equal to five times that of $500,000. the annual cash retainer.

For purposes of determining whether the stock ownership requirement is satisfied, a calculation is performed for each director annually as of the business day closest to June 30 of each year (the “Measurement Date”), utilizing the average closing price of the Company’s Common Stock for the90-day period ending on the Measurement Date. For new participants, the stock ownership requirement is initially determined as of the date that the director becomes a participant, utilizing the average closing price of the Company stock for the90-day period ending on that date.

Until the required level of ownership is met, a director is required to hold 50 percent50% of any shares of Common Stock acquired upon the lapse of restrictions on any stock grant and upon the exercise of stock options, net of any shares

DIRECTOR COMPENSATION

utilized to pay for the exercise price of the option and any tax withholding, if applicable.grant. If a director fails to meet or show progress towards satisfying these requirements, the CompensationCHC Committee may reduce future equity grants to that director. Once satisfied, each director is required to maintain the required level of stock ownership for his or hersuch director’s entire tenure of service on the Board. Each member of our Board is currently in compliance with the director stock ownership program, either through satisfying the required level of ownership, or by satisfying the holding requirement.

Summary of 20172023 Director Compensation toNon-Employee Directors

The compensation paid by the Company to thenon-employee directors for 20172023, other than Mr. Schechter, is set forth in the table below. Information on compensation for Mr. KingSchechter is set forth in the “Executive Compensation” section below (page 46)67).

| NAME |

FEES EARNED OR PAID IN CASH | RESTRICTED STOCK UNIT AWARDS ($)(2) | TOTAL ($) | |||||||||||||||||||||

Kerrii B. Anderson

|

$130,000

|

$164,948

|

$294,948

| |||||||||||||||||||||

Jean-Luc Bélingard

|

$105,000

|

$164,948

|

$269,948

| |||||||||||||||||||||

D. Gary Gilliland

|

$105,000

|

$164,948

|

$269,948

| |||||||||||||||||||||

Garheng Kong

|

$105,000

|

$164,948

|

$269,948

| |||||||||||||||||||||

Robert E. Mittelstaedt, Jr.

|

$150,000

|

$164,948

|

$314,948

| |||||||||||||||||||||

Peter M. Neupert

|

$120,000

|

$164,948

|

$284,948

| |||||||||||||||||||||

Richelle P. Parham

|

$105,000

|

$164,948

|

$269,948

| |||||||||||||||||||||

Adam H. Schechter

|

$125,000

|

$164,948

|

$289,948

| |||||||||||||||||||||

R. Sanders Williams

|

$120,000

|

$164,948

|

$284,948

| |||||||||||||||||||||

Name | Fees Earned or Paid in Cash ($)(1) | Restricted Stock Unit Awards ($)(2) | All Other Compensation ($)(3) | Total ($) | ||||||||||||||||

KERRII B. ANDERSON | $ | 130,714 | $ | 209,921 | $ | 93 | $ | 340,728 | ||||||||||||

JEAN-LUC BÉLINGARD | $ | 120,000 | $ | 209,921 | $ | 389 | $ | 330,310 | ||||||||||||

JEFFREY A. DAVIS | $ | 134,286 | $ | 209,921 | $ | 93 | $ | 344,300 | ||||||||||||

D. GARY GILLILAND, M.D., PH.D. | $ | 120,000 | $ | 209,921 | $ | 93 | $ | 330,014 | ||||||||||||

KIRSTEN M. KLIPHOUSE | $ | 120,000 | $ | 209,921 | $ | 93 | $ | 330,014 | ||||||||||||

GARHENG KONG, M.D., PH.D. | $ | 165,714 | $ | 209,921 | $ | 93 | $ | 375,728 | ||||||||||||

PETER M. NEUPERT | $ | 147,857 | $ | 209,921 | $ | 93 | $ | 357,871 | ||||||||||||

RICHELLE P. PARHAM | $ | 131,429 | $ | 209,921 | $ | 93 | $ | 341,433 | ||||||||||||

PAUL B. ROTHMAN, M.D. | $ | 68,242 | $ | 140,087 | $ | 95 | $ | 208,424 | ||||||||||||

KATHRYN E. WENGEL | $ | 120,000 | $ | 209,921 | $ | 93 | $ | 330,014 | ||||||||||||

R. SANDERS WILLIAMS, M.D. | $ | 140,000 | $ | 209,921 | $ | 93 | $ | 350,014 | ||||||||||||

| (1) | Includes annual retainer payments of |

| (2) | Amounts represent the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”) for restricted stock units awarded to each director in |

The aggregate number of vested and exercisable stock options held by each director as of December 31, 2017 was as follows: Ms. Anderson – 12,700; Mr. Bélingard – 14,700; Dr. Gilliland – 0; Dr. Kong – 0; Mr. Mittelstaedt – 9,400; Mr. Neupert – 0; Ms. Parham – 0; Mr. Schechter – 0; and Dr. Williams – 2,600. Beginning in 2013, as part of the realignment of our long-term incentive compensation, we ceased granting stock options to directors.

| (3) | Includes cash paid in lieu of fractional shares connection with the issuance of restricted stock unit awards or the satisfaction of tax obligations related thereto. |

32 LABORATORY CORPORATION OF AMERICA HOLDINGS

ELECTION OF DIRECTORS

The Board unanimously recommends that shareholders vote FOR the election of the following nominees. | ||||

Election of | ||||

ELECTION OF DIRECTORS

PROPOSAL ONE – ElectionThe full Board, upon recommendation of Directors

Thethe Nominating and Corporate Governance Committee, and the full Board havehas nominated each of David P. King, Kerrii B. Anderson,Jean-Luc Bélingard, Jeffrey A. Davis, D. Gary Gilliland, Kirsten M. Kliphouse, Garheng Kong, Robert E. Mittelstaedt, Jr., Peter M. Neupert, Richelle P. Parham, Paul B. Rothman, Adam H. Schechter, and R. Sanders WilliamsKathryn E. Wengel for election at the 2024 Annual Meeting to hold office until the next annual meeting of shareholders or until his or her earliersuch director’s death, resignation, or removal. Mr. Bélingard and Dr. Williams will retire from the Board effective as of the adjournment of the 2024 Annual Meeting and the size of the Board will be reduced to ten directors. All nominees have consented to serve, and the Board does not know of any reason why any nominee would be unable to serve. No director nominee is related to any of our other director nominees or executive officers, and there are no arrangements or understandings between a director and any other person pursuant to which such person was selected as a director nominee. If a nominee becomes unavailable or unable to serve before the 20182024 Annual Meeting, the Board can either reduce its size or designate a substitute nominee. If the Board designates a substitute, your proxy will be voted for the substitute nominee.

Information about each nominee is included below, including details about the nominee’s qualifications, skills, and experiences that supported the determination by the Nominating and Corporate Governance Committee and the Board that the person should serve as a director of LabCorp.Labcorp.

SKILLS KEY:

2024 PROXY STATEMENT 33

ELECTION OF DIRECTORS

Nominees to the Board of Directors

| Adam H. Schechter

Chairman, President and Chief Executive Officer

Age: 59Director

|

Professional Highlights: Adam H. Schechter has served as Skills and Qualifications: • Global and U.S.-focused leadership roles, while at Merck, spanning sales, marketing, and managed markets, as well as business and product development • Deep knowledge of the pharmaceutical and healthcare industries and extensive experience collaborating with • CERT Certificate in | ||||

Current Public Company Board Experience: • DaVita Inc. Other Current Relevant Experience: • Vice Chair of the Board of Directors

• Corporate Advisory Council for the | ||||||

ELECTION OF DIRECTORS

ELECTION OF DIRECTORS

|

Kerrii B. Independent Director Age: 66 Director Since: May 2006 Professional Highlights: Kerrii B. Anderson has served as a director of the Company since May

Skills • Strong record of leadership in operations and • Audit Committee financial expert • Extensive public company • Extensive financial, mergers and acquisitions, international, talent management, corporate governance and executive compensation experience • CERT Certificate in Cybersecurity Oversight | |||

Committees: • Audit Committee (Financial Expert) • Nominating and Corporate Governance Committee Current Public Company Board Experience: • Worthington Enterprises, Inc. • Abercrombie & Fitch Co. • The Sherwin-Williams Company Previous Public Company Board Experience: • Chiquita Brands International Inc., Chairwoman • PF Chang’s China Bistro, Inc. Other Current Relevant Experience: • The Columbus Foundation, Chairperson of the • Elon University, Board of Trustees and Audit Committee |

2024 PROXY STATEMENT 35

ELECTION OF DIRECTORS

|

Independent Director Age: 60 Director Since:December 2019 Professional Highlights: Jeffrey A. Davis has served as a director of the Company since

Skills • Extensive executive leadership • Extensive experience in operations, finance, capital structure, and mergers and acquisition • Audit Committee financial expert • Executive sponsor of diversity initiatives | |||

Committees: • Audit Committee (Chair) (Financial Expert) • Quality and Compliance Committee |

ELECTION OF DIRECTORS

ELECTION OF DIRECTORS

| D.

Independent Director Age: 69 Director Since: April 2014 Professional Highlights: D. Gary Gilliland has served as a director of the Company since April Skills and Qualifications: • Board-certified in Internal Medicine and

• Executive experience in clinical research | |||

Committees: • Audit Committee • Quality and Compliance Committee Current Public Company Board Experience: • Nuvalent, Inc. Other Current Relevant Experience: • Fellow of the American Association for Cancer Research (AACR) • Member of the American Society for Clinical Investigation (ASCI) • Member of the Association of American Physicians (AAP) • Member of the American Academy of Arts and Sciences (AAA&S) • Member of the National Academy of Medicine (NAM) |

2024 PROXY STATEMENT 37

ELECTION OF DIRECTORS

|

Kirsten M. Kliphouse Independent Director Age: 57 Director Since: October 2022 Professional Highlights: Kirsten M. Kliphouse has served as a director of the Company since October 2022. Ms. Kliphouse previously served as the President of Google Cloud Americas, a position she held from March 2022 to July 2023, where she was responsible for leading and growing the sales, go-to-market, customer engagement, channel, and services organizations. At Google Cloud, she also served as the Global Chair of the Aspiring Leadership Academy and Women@Google Cloud. Prior to her position as President, Ms. Kliphouse served as President of the North American division of Google Cloud from June 2019 to March 2022. Prior to Google Cloud, Ms. Kliphouse was Senior Vice President at Red Hat, Inc., a subsidiary of International Business Machines Corporation, Chief Executive Officer of Yardarm Technologies, a hardware and software solutions company, and founder and Chief Executive Officer of Scaling Ventures, a technology investment and advisory firm. Prior to her position at Yardarm, Ms. Kliphouse spent more than 25 years at Microsoft, Inc., where she was part of the executive leadership team and held numerous executive positions in Enterprise Sales, Original Equipment Manufacturers (OEM), Partner and Channels, and as Corporate Vice President of Customer Support, Success and Professional Services, during which she led more than 10,000-employees globally. Ms. Kliphouse is a recipient of the Founders Award for her superior leadership and contributions to the business. Ms. Kliphouse holds a degree in Computer Information Sciences and Business from Muhlenberg College. Skills and Qualifications: • Global cybersecurity incident response and remediation • Executive leadership experience including by delivering operational and financial results • Depth of experience within the technology sector, mergers and acquisitions, and business development • CERT Certificate in Cybersecurity Oversight | |||

Committees: • Audit Committee Current Public Company Board Experience: • Dun & Bradstreet Holdings, Inc. • Global Payments, Inc. |

38 LABORATORY CORPORATION OF AMERICA HOLDINGS

ELECTION OF DIRECTORS

| Garheng Kong, M.D., PH.D.

Independent Director Age: 48 Director Since: December 2013 Professional Highlights: Garheng Kong has served as a director of the Company since December

Skills • Knowledge and experience in both the healthcare and finance fields • Executive leadership • Life science-related venture • Corporate governance expertise through |

ELECTION OF DIRECTORSboards

•Lead Independent Director

|

Current Public Company • Lunit Inc. (KOSDAQ: 328130) • Venus Concept Inc. • Xeris Biopharma Holdings, Inc. (formerly Strongbridge Biopharma plc) Previous Public Company Board Experience: • Histogenics Corporation • Avedro, Inc. • Melinta Therapeutics, Inc. • Alimera Sciences, Inc. Other Current Relevant Experience: • Duke University School of

• Dell Children’s Foundation, Board of • Austin Healthcare Council |

2024 PROXY STATEMENT 39

ELECTION OF DIRECTORS

|

Peter M.

Independent Director Age: 68 Director Since: January 2013 Professional Highlights: Peter M. Neupert has served as a director of the Company since January 2013. Mr. Neupert was an Operating Partner at Health Evolution Partners, a health only, middle market private equity firm, from January 2012 until June 2015. Prior to that, Mr. Neupert served as Corporate Vice President of the Microsoft Health Solutions Group from its formation in 2005 to January 2012. In addition, Mr. Neupert was a member of the Institute of Medicine’s Roundtable on Value & Science-Driven Healthcare from 2007 to 2012, a workshop dedicated to transforming the way evidence on clinical effectiveness is generated and used to improve health and healthcare. Mr. Neupert also served on the U.S. President’s Information Technology Advisory Committee, Skills and • Expertise in health information technology and

• Corporate governance and • Expertise and |

ELECTION OF DIRECTORSmatters

• Audit Committee (Financial Expert)

Current Public Company Board Experience: • Adaptive Biotechnologies Corporation, Lead Independent Director

Previous Public Company Board Experience: • Quality Systems, Inc. (now NextGen Healthcare, Inc.) • AQuantive.com • drugstore.com, Chairman |

40 LABORATORY CORPORATION OF AMERICA HOLDINGS

ELECTION OF DIRECTORS

|

Richelle P. Independent Director Age: 56 Director Since: February 2016 Professional Highlights: Richelle P. Parham has served as a director of the Company since February

Skills • Extensive senior-level executive experience, including in corporate finance, and mergers and • More than 20 years of global strategy and marketing experience, as well as expertise in understanding consumers and the consumer decision | |||

Committees: •Compensation and Human Capital Committee (Chair) • Nominating and Corporate Governance Committee Current Public Company Board Experience: • Best Buy Co., Inc. Previous Public Company Board Experience: • Scripps Network Interactive Inc. • e.l.f. Beauty, Inc. Other Current Relevant Experience: • Drexel University, Board of Trustees |

2024 PROXY STATEMENT 41

ELECTION OF DIRECTORS

|

Independent Director Age: 65 Director Since: June 2023 Professional Highlights: Paul B. Rothman has served as a director of the Company and member of the Quality and Compliance Committee since June 2023. Dr. Rothman, a rheumatologist and molecular immunologist, was previously the Dean of the Medical Faculty for Johns Hopkins University School of Medicine and CEO of Johns Hopkins Medicine, during which time he oversaw both the Johns Hopkins Health System and the School of Medicine. Prior to serving at Johns Hopkins, Dr. Rothman held various leadership positions at Columbia University and the University of Iowa. Dr. Rothman holds a Bachelor of Science in biology from the Massachusetts Institute of Technology and an M.D. from Yale University. Skills and Qualifications: • Extensive expertise in patient care, science, and medicine relevant to the clinical laboratory business • Operational, management, and executive leadership experience • Deep understanding of the complexity of the U.S. healthcare delivery system and policy development | |||

Committees: •Quality and Compliance Committee Current Public Company Board Experience: • Merck and Co. Previous Public Company Board Experience: • Cancer Genetics, Inc. Other Current Relevant Experience: • King Faisal Specialist Hospital and Research Center in Saudi Arabia, Board of Directors • Member of the American Society for Clinical Investigation (ASCI) • Member of the Association of American Physicians (AAP) • Member of the American Academy of Arts and Sciences (AAA&S) • Member of the National Academy of Medicine (NAM) • Member of the American Association for the Advancement of Sciences (AAAS) |

42 LABORATORY CORPORATION OF AMERICA HOLDINGS

ELECTION OF DIRECTORS

| Kathryn E. Wengel Independent Director Age: 58 Director Since: March 2021 Professional Highlights: Kathryn E. Wengel has served as a director of the Company since

|

ELECTION OF DIRECTORS

|

Skills and Qualifications: • Extensive global experience in managing complex supply chains, operations, and quality and compliance • Knowledge and experience in the healthcare field • Executive leadership experience • Advocate and sponsor of several key diversity initiatives | |

Committees: • Compensation and Human Capital Committee • Quality and Compliance Committee Other Current Relevant Experience: • GS1 Global, Management Board member •National

|

The Board unanimously recommends that shareholders vote “FOR” the election of the nominees listed above.

2024 PROXY STATEMENT 43

Executive Officers

Information regarding each of LabCorp’sLabcorp’s current executive officers and their relevant business experience is summarized below.

David P. KingAdam H. Schechter

President and Chief Executive Officer

See “Proposal One: Election of Directors” (page 19)33) for information about Mr. King.Schechter.

Megan D. Bailey

Executive Vice President and Chief Strategy and Transformation Officer

Megan D. Bailey (44) has served as Executive Vice President and Chief Strategy and Transformation Officer since May 2023. Prior to that, Ms. Bailey served as Chief of Staff to the Chief Executive Officer and an Executive Committee member since July 2022. Ms. Bailey served as Chief Executive Officer and a member of the Board of Directors of Personal Genome Diagnostics (PGDx), a cancer genomics company, prior to its acquisition by Labcorp, from April 2020 to July 2022, as well as Chief Commercial Officer, from January 2020 to April 2020, and Vice President, Marketing, from March 2018 to January 2020. Ms. Bailey has more than 20 years of leadership experience in the healthcare industry, including more than 10 years at Roche Diagnostics, most recently serving as Senior Director of Commercial Operations, where she was responsible for leading commercial organizations across four divisions that spanned clinical chemistry, molecular diagnostics, tissue diagnostics, and point of care portfolios addressing multiple market segments. Ms. Bailey serves as a member of the Novo Holdings Advisory Group, on the University of Maryland Baltimore Foundation Board of Trustees, and on the Army West Point Athletic Association Board of Directors. Ms. Bailey is a graduate of the United States Military Academy at West Point and holds a Master of Public Health from the University of North Carolina at Chapel Hill.

Lance V. Berberian

Executive Vice President and Chief Information and Technology Officer

Lance V. Berberian (61) has served as Executive Vice President and Chief Information and Technology Officer since February 2020. Prior to that he served as Senior Vice President and Chief Information Officer

Mr. Berberian (55) has from February 2014. Prior to joining Labcorp, he served as Senior Vice President, Chief Information Officer since February 2014. From May 2007 to January 2014, he served asthe Chief Information Officer at IDEXX Laboratories, Inc., a global leader in diagnostics and IT solutions for animal health and food and water quality.quality, from 2007 to 2014. Mr. Berberian also served as Chief Information Officer and President of Kellstrom Defense Aerospace Defense,Inc., a fully integrated supply chain firm, from January 2000 to April 2007. He also served asPrior to that, he was the Chief Information Officer of Interim HealthcareHealthCare Inc. from September 1997 to January 2000. Mr. Berberian serves as a Strategic Advisory Board member for North Carolina State University’s Department of Computer Science, on the Advisory Board of the Master of Science in Informatics and Analytics program for University of NC Greensboro, on the University of Chapel Hill’s Carolina Health Informatics Program Health IT Advisory Board, and on the Board of Trustees at Elon University. Mr. Berberian holds Bachelor’s degrees in Business Administration and Information Technology from Thomas Edison State College.

Brian J. Caveney, M.D., J.D., M.P.H.MPH

Executive Vice President and President, Early Development Research Laboratories and Chief Medical and Scientific Officer

Brian J. Caveney (44)(50) has served as Executive Vice President and President Early Development Research Laboratories and Chief Medical and Scientific Officer since May 2023, having previously served as Executive Vice President and President, Diagnostics and Chief Medical Officer since November 2019. Prior to that he served as Senior Vice President and Chief Medical Officer, sincebeginning in September 2017. In this role, he has broad responsibility for the medical and scientific strategy of the enterprise. Prior toFrom 2011 until joining the company,Company, Dr. Caveney worked at Blue Cross NC since May 2011, including serving as chief medical officer from February 2016 to September 2017.and Blue Shield of North Carolina (Blue Cross NC), a health care insurance provider, and was most recently Blue Cross NC’s Chief Medical Officer. In addition to various roles in the Healthcare Division of the core

44 LABORATORY CORPORATION OF AMERICA HOLDINGS

EXECUTIVE OFFICERS

health plan, Dr. Caveney also served as chief clinical officerChief Clinical Officer of Mosaic Health Solutions, a wholly owned subsidiary of Blue Cross NC for strategic investments in diversified health solutions businesses. Prior to joining Blue Cross NC, Dr. Caveney was a practicing physician and assistant professor at Duke University Medical Center and also provided consulting services for several companies in the Research Triangle Park, North Carolina region. Dr. Caveney holds an M.D. from the West Virginia University School of Medicine, a J.D. from the West Virginia University College of Law, and an M.P.H. in Health Policy and Administration from the University of North Carolina at Chapel Hill. He completed his residency at Duke University Medical Center and is board-certified in preventive medicine, with a specialty in occupational and environmental medicine. He is the past president of the Southeastern Atlantic College of Occupational and Environmental Medicine.

Edward T. DodsonJonathan P. DiVincenzo

SeniorExecutive Vice President and Chief Accounting OfficerPresident, Central Laboratories and International

Mr. Dodson (64)Jonathan P. DiVincenzo (58) has served as Executive Vice President and President, Central Laboratories and International since May 2023. Mr. DiVincenzo has been with Labcorp since August 2017, serving as President, Clinical Trials Testing Solutions since October 2019, and prior to that, as Senior Vice President, Chief Accounting OfficerGM, Covance, since June 2005. He also has served as the Principal Accounting Officer since December 2014.August 2017. Under Mr. Dodson, who has been a Certified Public Accountant for 35 years, joined the Company in August 1997 as Vice President and Corporate Controller and became Senior Vice President in June 2001. Prior to joining the Company in 1997, Mr. Dodson was a senior managerDiVincenzo’s leadership, Labcorp opened new anatomic pathology facilities in the auditUnited States and consulting practiceabroad and completed the expansion of KPMG LLP, where he worked for 17 yearsanatomic pathology, genomics and microbiology labs in that firm’s Greensboro, North CarolinaSingapore, China, and Brussels,Japan. In addition, Mr. DiVincenzo led Labcorp’s efforts to automate its kit assembly line in Mechelen, Belgium offices.

F. Samuel Eberts III, J.D.

Senior Vice President, Chief Legal Officer and Secretary

Mr. Eberts (58) has served as Senior Vice President, Chief Legal Officer, Secretary and Chief Compliance Officer since January 1, 2009. Prior to that datethe construction of a new kit production facility in Suzhou, China. Before joining Labcorp, he served as Senior Vice President General Counsel since August 2004.of the Environmental Health division of PerkinElmer, a precision optics corporation. Prior to joining the Company,PerkinElmer, he was Vicehas held numerous leadership roles, including President Secretary, and General Counsel of Stepan Company. Before joining Stepan Company, he was Assistant General Counsel for Cardinal Health, Inc. from 1998 to 2001Chief Executive Officer at Enzymatics and Associate General Counsel for Allegiance Healthcare Corporation (Allegiance Healthcare Corporation was purchased by Cardinal Health in 1998). Prior to that time, he was Chief CounselPresident of the Biotech North America divisionBioscience Division of Baxter International Inc.EMD Millipore, a subsidiary of Merk KGaA. Mr. DiVincenzo holds a Bachelor’s degree in Mechanical Engineering from Northeastern University.

EXECUTIVE OFFICERS

Glenn A. Eisenberg

Executive Vice President and Chief Financial Officer

Mr.Glenn A. Eisenberg (56)(62) has served as Executive Vice President and Chief Financial Officer since June 2014. Mr. Eisenberg received his Bachelors of Arts degree from Tulane University in 1982 and his Master of Business Administration from Georgia State University in 1988. From 2002 until he joinedjoining the Company, he served as the Executive Vice President of Finance and Administration and Chief Financial Officer at The Timken Company, a $4.3 billion leading global manufacturer of highly engineered bearings and alloy steels and related products and services. Previously, he served as President and Chief Operating Officer of United Dominion Industries, a diversified industrial manufacturer, now a subsidiary of SPX Corporation, after working in several roles in finance, including Executive Vice President and Chief Financial Officer of United Dominion.Officer. With respect to Mr. Eisenberg’s public company board experience, Mr. Eisenberg servesis expected to serve on the board of directors and the audit committee of Solventum Corporation upon completion of its spin-off. Previously, Mr. Eisenberg served on the Board of Directors of USU.S. Ecology, Inc. since February 2018. Mr. Eisenbergfrom November 2019 to May 2022, where he chaired the Audit Committee, on the Board of Perspecta Inc., from May 2019 to May 2021, where he served on the Audit Committee, on the Board of Directors of Family Dollar Stores Inc. untilfrom November 2002 to July 2015, where he chaired the Audit Committee, and Alpha Natural Resources Inc. from July 2009 to May 2015, where he served as lead independent director and chaired the Nominating and Corporate Governance Committee. Mr. Eisenberg holds a Bachelor of Arts degree from Tulane University and a Master of Business Administration from Georgia State University.

Anita Z. Graham

Executive Vice President and Chief Human Resources Officer